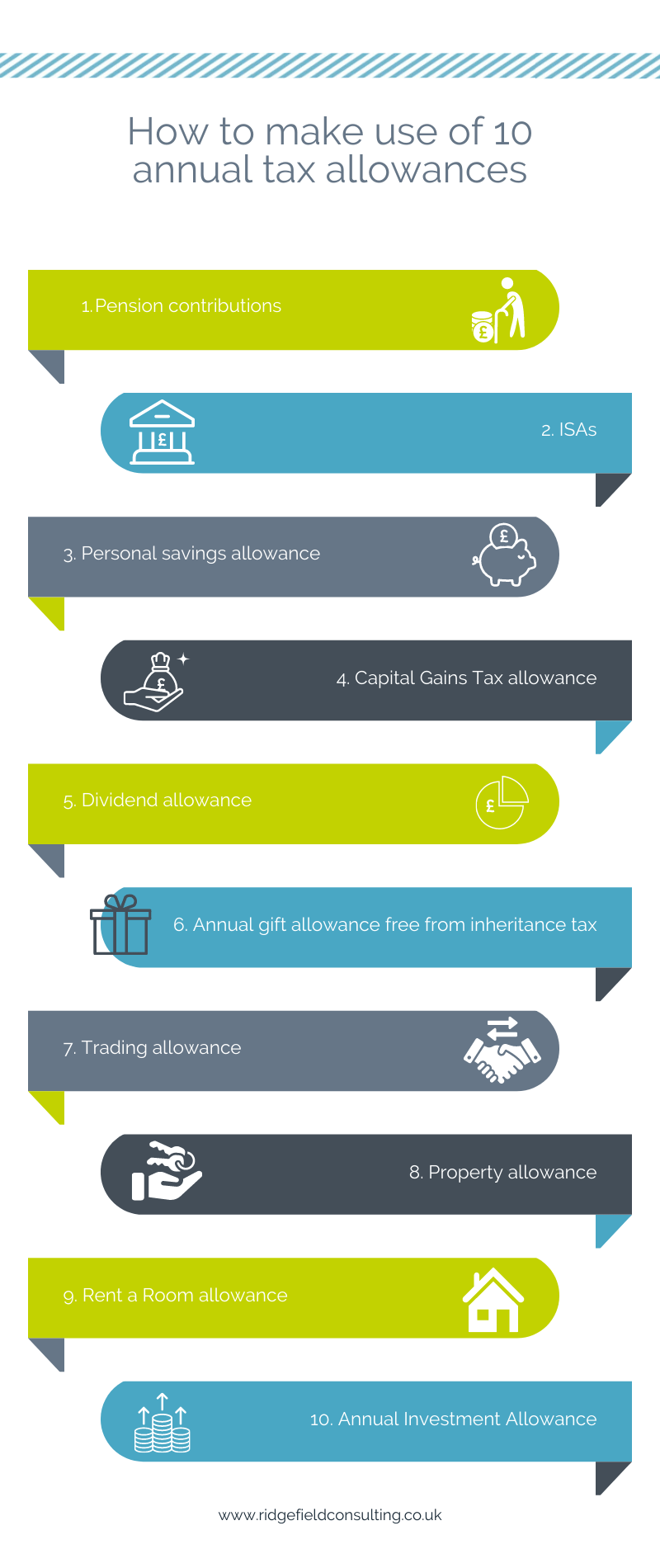

How to make use of 10 annual tax allowances

How to make use of 10 annual tax allowances

There are many ways you can be smart with your money. Making full use of tax allowances is one. Below, we guide you through ten possible allowances for you to take advantage of.

1. Pension Contributions

Often overlooked, making pension contributions allows you to gain generous tax relief benefits. Every time you add to your pension fund, the government takes what you would have paid in tax for that amount had you have kept the money as income, and puts it back into your own pension fund as a top up. The amount you receive as a top up is dependent upon your personal income tax band and more on how this works is explained in full in our article ‘Why paying into a pension fund is so tax efficient’.

There is a maximum annual allowance in terms of how much you can put into your pension fund each year. For the tax year 2022/23, you are allowed to save up to a maximum of £60,000 or 100% of your total earned income so long as this is less than £60,000. Any amount you pay into your pension fund which goes over this allowance will be liable to be taxed as part of your income, however you can also make use of the previous three years’ allowances if they were not fully used up at the time. In order to carry forward the allowance from previous years you need to have been paying into a pension scheme at the time and also be earning at least the amount you wish to put into the pension fund.

2. ISAs

Individual savings account, or ISAs, as they’re more commonly referred to, are types of savings or investment accounts that allow you to enjoy any interest earned tax-free. There are various different ISAs available, each have their own specific benefits as well as allowances.

- Cash ISA – A savings account ISA which allows you to put in up to £20,000 per year. Interest earned is tax-free.

- Stocks and shares ISA – An investment account which allows you to put in up to £20,000 per year. Any gain made should you sell the stocks and shares is not liable to capital gains tax. If you receive dividends from the stocks and shares, they are not subject to income tax.

- Help-to-buy ISA – A savings account for first time home buyers. This is no longer available to new applicants as of 30 November 2019 but anyone with an existing account can continue to save until November 2029. The maximum you can put into this ISA account is £3,400 for the first year and £2,400 thereafter. The government will top up any amount you put in by 25% and interest earned on these accounts is tax-free.

- Lifetime cash ISA – A savings account for a house deposit or as retirement savings. You can put in up to £4,000 a year and only those aged 18 – 39 can open this type of ISA account.

- Lifetime stocks and shares ISA – An investment account for a house deposit or as a retirement investment account. You can put in up to £4,000 a year and only those aged 18 – 39 can open this type of ISA account.

Do not forget about Junior ISAs. They can be a valuable option to help save for a child’s future. The ISA has to be opened on behalf of the child by a parent or guardian, but the money will belong to the child and will be accessible once they are 18 years old.

- Junior cash ISA – A savings account ISA where up to £9,000 can be put in per year. All interest earned is tax-free.

- Junior stocks and shares ISA – An investment account where up to £9,000 can be put in per year. Any gain made through the sale or disposal of stocks and shares is not liable to capital gains tax. Where dividends are received, they are not subject to income tax.

3. Personal Savings Allowance

Separate to any ISA allowance, the personal savings allowance means that you are able to receive interest from your savings account without having to pay tax up to a certain amount:

- Basic rate taxpayers – can earn up to £1,000 tax free

- Higher rate taxpayers – can earn up to £500 tax free

- Additional rate taxpayers – do not have a personal savings allowance

- If your taxable income is less than £17,500 per year, then you will not have to pay any tax on savings income

Where you have used up the maximum allowance for your ISA, remember to also make use of this personal savings allowance.

4. Capital Gains Tax

Capital Gains Tax (CGT) is tax that you are required to pay on gains made when you sell or dispose of an asset that has increased in value. The most common examples of assets that are likely to incur CGT are personal possessions with a value of over £6,000 (excluding cars), property that is not your main residence, shares and stocks (excluding ISA or PEP) and business assets.

CGT rates are dependent on your personal income tax band and what type of asset you are disposing of:

- Basic rate taxpayer disposing of property – 18% (For commercial property this is 10%)

- Basic rate taxpayer disposing of any other asset – 10%

- Higher or additional rate taxpayer disposing of property – 28% (For commercial property this is 20%)

- Higher or additional rate taxpayer disposing of any other asset – 20%

Each year, a person is entitled to a CGT exemption. For the 2023/24 tax year you can earn a gain of up to £6,000 that is tax free. If you are a married couple or in a civil partnership you can use both your allowances together to earn up to £12,000 tax-free. However, if you do not use your allowance in one year, you are not able to carry it forward. You may therefore want to plan to spread out any disposals in order to make the most out of the allowance each year.

5. Dividend Rates

Dividends are payments made to company shareholders from the company’s profits. You may be receiving dividends if you have invested in shares, or if you are a director of your own limited company (read our article on The Difference between Director’s Salary and Dividends to find out why). Although dividends will make up part of your income, they are taxed at different rates to income tax and have their own allowance. For the tax year 2023/24 every individual is able to receive up to £1,000 in dividends tax-free. Any amount received above this threshold will be charged at different rates depending on your personal income tax band:

- Basic rate taxpayers – 8.75%

- Higher rate taxpayers – 33.75%

- Additional rate taxpayers – 39.35%

The dividend tax allowance cannot be carried forward so if you do not use it one year, you won’t be able to claim for it in future years.

6. Inheritance Tax Gifts

Inheritance tax is often faced with the most resentment from taxpayers as it attracts an eye-watering flat rate of 40% once the nil-rate band (£325,000) and residence nil-rate band (£175,000) have been exhausted. Understandably most people would want to pass on their wealth to their loved ones rather than HMRC and if you have an estate greater than £500,000 then we would highly suggest our Inheritance Tax Planning service.

However, throughout your lifetime, there are smaller allowances which you can make use of to pre-empt having a large estate that’s susceptible to the whopping 40% rate. Each year you can give away assets or cash of up to a total value of £3,000 to as many people as you like. You are also able to carry forward this allowance but only up to a maximum value of £6,000 in one year. In addition, smaller gifts of up to £250 are also allowed, so long as they are not given to the same people who will be benefiting from a gift of up to £3,000.

Other gifts which are not included in this allowance can be made for special occasions such as weddings. The allowance for these gifts is up to £5,000 for your children, £2,500 for grandchildren, or £1,000 for friends or any other person. Additional ways you can gift away your estate include regular gifts out of excess income, such as birthday and Christmas presents, but you must prove that you are able to maintain your current standard of living after making the said gifts and gifts to help with living costs of dependents which are exempt from the annual allowances, such as costs for care of elderly relatives or costs for education for children under 18.

7. Trading Allowance

The trading allowance is applicable to anyone with small amounts of trading or miscellaneous income. Where you make any money from your own sole trader business that is under £1,000 you are not required to file for a self-assessment tax return or pay tax on these earnings. This allowance may therefore encourage you to start up a small side-business or to monetise a hobby such as selling photography prints.

Bear in mind that if you go over this limit you will then need to complete a self-assessment tax return and pay income tax on earnings over the £1,000 threshold. You can still claim the £1,000 allowance as partial relief, however it may be more cost efficient to deduct your actual business expenses instead. You can deduct one or the other from sole trader income but not both.

There are also some exemptions to be aware of as the trading allowance is not available to:

- Limited companies or partnership trades

- Income which is eligible for rent a room relief

- Trading income which has been received from an employer or your spouse/civil partner’s employer

- Trading income which has been received from a company or partnership which you are closely associated with

8. Property Allowance

Similar to the trading allowance, the property allowance was introduced in April 2017 and gave taxpayers a simple one-off £1,000 annual tax relief on rental income. It’s most suitable for those with few or no expenses on rental property, or where you have misplaced receipts for your expenses. Married couples or civil partners who are joint owners of property and land can both claim £1,000 each, even if they share the rental income. You cannot claim this allowance for income earned from letting a room in your own home but continue to read below to find out about the rent a room allowance.

9. Rent a Room Allowance

The Rent-A-Room Allowance is a scheme which lets you receive up to £7,500 a year tax free from a lodger by renting out a room in your own home. The scheme requires you to rent out fully furnished accommodation and it must be in your main home. You don’t have to be the owner of the property to be eligible but must have permission to sub-let from the landlord and the home insurance provider. As of April 2019, an additional condition imposed includes that you must be living in the same property as the lodger for at least some of the letting period.

Where you meet all these conditions you can claim tax relief of £7,500 on the rental income, however if you share ownership of the property with someone else then you’ll only be able to claim up to £3,750 each. There are also rules on when and what you can deduct on a self-assessment tax return:

- If you have no other income which is not taxed at source and your rental earning is under £7,500 then you do not have to complete a self-assessment tax return.

- If you’re already required to complete a self-assessment tax return and your rental earning is under £7,500 then you need to continue filing and also declare the rental income but you will not need to pay tax on this portion of your earnings.

- If you earn over £7,500 through renting a room out, then you will need to complete a self-assessment tax return and you can choose to deduct £7,500 so long as you do not claim for expenses or capital allowances.

- The other option if you earn over £7,500 through renting out a room is to complete a self-assessment tax return form and pay tax on the actual profit made whilst also being able to deduct expenses or capital allowance but sacrifice the £7,500 tax relief.

10. Annual Investment Allowance

The Annual Investment Allowance (AIA) is a form of tax relief for businesses that allows them to deduct the total amount of qualifying capital expenditure up to a certain limit from its taxable profits in a given tax year. Since April 2023, the limit has been set permanently at £1,000,000 and can be claimed by limited companies, but not sole traders or partnerships.

Most assets purchased for business purposes can be claimed as qualifying expenses for AIA, for example office equipment, integral features of a building, lorries/vans and machinery. Some assets cannot be claimed though, including buildings, cars, land, and structures. The AIA is a useful allowance for business owners that allows them to offset capital expenditure against their profits to reduce the tax bill.

These are some of the most useful and simple allowances you can make use of yourself. For more strategic tax planning on how to take advantage of allowances taking into consideration various streams of income and personal goals, we would like to point you towards our Personal Tax Planning service page.

Stay up to date

Looking for some help?

You can find out more about our Self Assessment Tax Return Service.