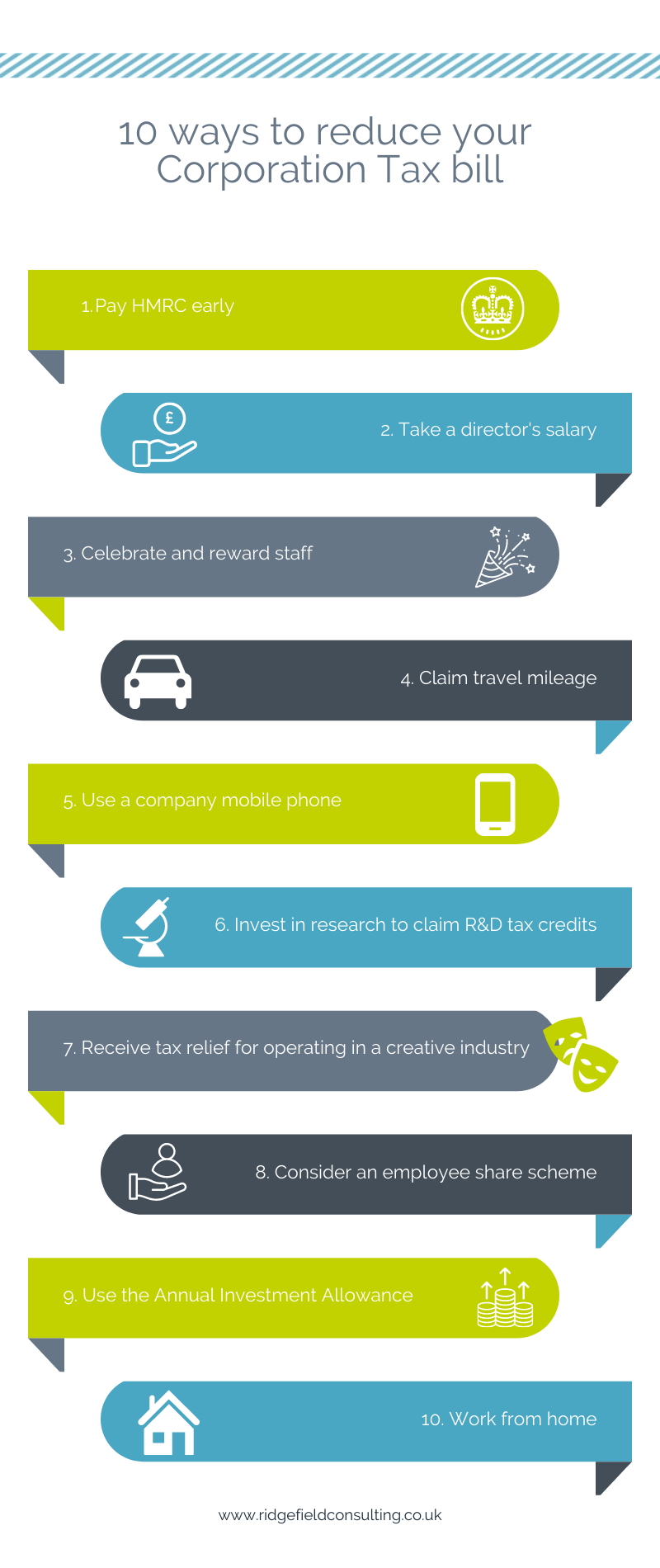

10 Ways to Reduce your Corporation Tax Bill

10 Ways to Reduce your Corporation Tax Bill

Small business owners who operate through a limited company will likely be aware that corporation tax is only paid on the profits made through the company. However, not all business expenses are tax deductible and so, although you may incur legitimate expenses running your business, for the purpose of completing your company tax return and paying corporation tax, some of those expenses will be added back on as profit. One of the most common examples of a non-tax-deductible business expense is client entertainment. Nevertheless, there are still plenty of expenses that you should ensure you are claiming for which will reduce your corporation tax bill, as well as tax relief you may be able to claim, and a tip or two which will help further reduce your tax bill as outlined below:

- Pay HMRC early

First top tip for you! Did you know that paying your corporation tax early will not only reduce the risk of missing deadlines and incurring penalties, but can even earn you interest? HMRC rewards those who pay their corporation tax early with a small percentage interest of 0.5%. The earliest you can pay for your corporation tax is 6 months and 13 days after the start of your accounting period. In practice, this mean you will have to pay an upfront estimate of what you believe your corporation tax bill is likely to be for the whole year. If your accounting period runs from 1 January until 31 December each year, then the earliest you can pay is 13 June. The latest you can pay for this accounting period is the usual company tax return deadline of 9 months and 1 day – therefore would be 1 October in the year following the end of your accounting period. However, don’t be caught out by the details – the interest earned on early payments is considered part of your company’s income and therefore must be declared on your company tax return for which it will be liable to tax. To take advantage of this incentive, find out how to file your company tax return.

- Directors should take a salary

One advantage of being a company director of your own limited company is the flexibility of how you can pay yourself. Directors can receive payments in the form of salaries or dividends. Taking a salary is an effective way to reduce your corporation tax because HMRC considers salaries for employees (including directors) as a tax-deductible business expense. Dividends on the other hand are not tax-deductible and can only be taken from a company’s profits. This means that corporation tax must be paid on the overall profits first before dividends can be taken.

Although taking a salary will help reduce your corporation tax, it is important to bear in mind that any salary received is subject to income tax. It is therefore advisable to take out a combination of both, and we have written an in-depth article on the most efficient way to take out a director’s salary and dividends.

- Celebrate and reward staff with annual events

One of the most common misunderstandings that catches out small business owners is the difference between client entertainment expenses for the business and staff entertainment expenses for the business. Client entertainment is a non-allowable expense for tax purposes, meaning you cannot deduct this expense from your profits when calculating your corporation tax. Staff entertainment however can be an allowable expense, so long as you follow all the rules. This is why so many companies decide to hold Christmas parties, team building away days or other events, as it not only helps boost staff morale, but helps reduce the corporation tax bill.

There is also no need to report the staff entertainment as a benefit in kind (BIK) so long as the event is held in a way which complies with all the conditions that enable it to be tax-deductible. To ensure compliance, the event must be held annually (around the same time each year) and cannot be a one-off celebration. Every employee must be invited, and no one can be left out or uninvited. The budget for staff entertainment cannot exceed the maximum of £150 per person per year, which means you can use this budget to hold multiple events and the amount does not have to be spent in one go. The company can even claim back the VAT on costs for the party or event so long as only employees are in attendance and external people such as subcontractors, suppliers or employees’ partners have not been included.

Our second top tip is that you can make use of this allowance, even where you do not have any employees! Directors of their own limited companies with no employees are still able to treat themselves to a celebratory event so long as they still meet all the conditions outlined above.

- Claim travel mileage

Limited companies are able to consider several ways in which to reduce their corporation tax through the claiming of mileage expenses. For small limited companies with few employees, the simplest and most tax-efficient way is to run your own personal vehicles for business travel and claim back fixed-rate mileage expenses from the company. The alternatives, which include using a pool car, company car or company van, can offer some tax relief to the company by means of capital allowances but can also attract other forms of tax for both the company and the employee as a BIK.

Where employees of limited companies (including directors) use their own personal vehicle for business use, they can claim up to 10,000 miles per year at a fixed rate of 45p per mile. For anything over this limit, the fixed rate drops to 25p per mile. Only mileage for business purposes can be claimed, such as for an external meeting. Mileage for day to day commuting to an office which is your normal place of work cannot be claimed. The company can reimburse employees for these costs whilst also claiming the cost as an allowable expense to reduce corporation tax.

- Use a company mobile phone

With flexible working on the rise, more and more employees are working from home. Where they need to make business calls to clients or customers, you may want to consider providing them with a company mobile phone so that they do not need to use their personal phones. Directors of limited companies can also take advantage of this.

However, to ensure that the provision of a mobile phone does not amount to a BIK, several conditions need to be satisfied. Firstly, the phone must remain an asset of the business and cannot belong to the employee. This means that, when an employee leaves, they will need to return the phone to the company. Secondly, the phone cannot be exchanged for a higher salary. This means that employees should not be given the option to sacrifice having a work mobile in exchange for a higher salary which they may then use to pay for their own personal phone. Thirdly, only one work phone can be provided to each employee. For example, if you are a director and you decide you need two work mobiles because you will use one for UK clients and the other for international clients, the second phone will attract tax and national insurance as a BIK. Finally, any contract which is taken out alongside the mobile phone must also be taken out under the company’s name, with the company paying for the bill. It may therefore be a good idea to ensure that all employees understand that they must not exceed the phone’s contractual limits of minutes, messages or data.

Where all conditions are met, the cost of the device plus the contract is an allowable tax-deductible expense that can help reduce corporation tax.

- Invest in Research and Development to claim R&D tax credits

Many businesses mistakenly believe that they cannot make use of R&D tax credits because they are not working in a traditionally innovative industry. However, in most cases, so long as the company is investing in creating a new product, process or service, or is investing to substantially improve an existing product, process or service, which requires overcoming a key element of uncertainty, then it’s very possible that they may be able to claim for qualifying expenses.

Where a company is eligible to claim for R&D tax credits, some of the normal tax-deductible business expenses such as salaries, materials, software etc. not only reduce the corporation tax bill, but a portion of it can be repaid to the company in the form of tax credits. How much you can receive is all dependent on the size of the company and whether the company is loss or profit making. Find out all about how R&D tax credit work.

- Receive tax relief for operating in a creative industry

Certain industries, such as those working in the creative sector, can find it more difficult to qualify for R&D tax credits. As an alternative, the government devised eight corporation tax reliefs specific to certain creative industries:

- Film Tax Relief

- Animation Tax Relief

- High-end Television Tax Relief

- Video Games Tax Relief

- Children’s Television Tax Relief

- Theatre Tax Relief

- Orchestra Tax Relief

- Museums and Galleries Exhibition Tax Relief

Qualifying businesses that are eligible to claim one of the eight tax relief options above are able to reduce their corporation tax by increasing their business expenses on their company tax return. The amount of additional deductions they can make is either 80% of the total core expenditure, the amount of UK core expenditure, or the amount of core expenditure on goods and services that are provided from the European Economic Area (if applicable) – whichever is less.

Many companies eligible for these tax reliefs will often need to report a loss during production of the product and only earn profit once the product is available to customers. As such, they will have the option to carry some of the loss forward to offset against future profit. There are certain rules as to how much can be carried forwards, and this is usually dependent upon the stage of production that the company is in when reporting the loss. Alternatively, companies will also have the option to surrender some or all of the loss for a tax credit instead. This means that where the company does not want to carry the loss forward, they can choose to receive a portion of the loss as cash back. The amount that can be received ranges from 20% – 25% of the loss depending on the specific relief and additional conditions.

Production of films, animations, television programmes or games will only qualify for the relevant tax relief if they are certified as British by the British Film Institute. They must also pass a cultural test or qualify through an internationally agreed co-production treaty. Each individual tax relief will also have additional conditions specific to the industry and more information can be found here.

- Consider an employee share scheme

Employee share schemes offer the opportunity for employees to acquire equity in the company. These arrangements are often offered in order to attract high quality skilled employees, retain them, and motivate them to help the business grow further. There are broadly two categories of employee share schemes – approved and unapproved. Approved schemes are ones which HMRC allow for tax benefits where unapproved schemes do not.

By using an approved employee share scheme such as the Enterprise Management Incentive scheme (EMI), both employees and the company can receive tax advantages. For employees, they will face no income tax on exercising the share option. For employers, they are able to reduce their corporation tax bill when employees exercise their share option as they normally receive below market price for the shares and can offset this against their profits.

- Take advantage of the annual investment allowance

All limited companies can make use of the annual investment allowance (AIA) which is where the full cost of some plant and machinery that has been purchased outright for business use can be deducted from profits before tax. Plant and machinery does not include assets which are leased, buildings, land, structures or items used for business entertainment. Other assets which cannot be claimed for AIA includes cars (but does include vans), items you owned for other purposes before you started using them for the business and items given to the business for free.

The maximum you can claim for is assets up to a value of £1 million . Therefore, if you were looking to invest in the business by purchasing office furniture such as desks or equipment including computers and printers, these costs can deducted in full from the company’s profits before tax.

- Work from home

Many small businesses, especially start-ups, operate from home. The good news is that HMRC allows for businesses to claim some costs of using the space and utilities of a personal home as a tax-deductible expense to reduce your corporation tax.

There are two options:

- Claim a flat rate of £6 per week (an allowance of £312 per year for the 2023/24 tax year)

- Rent a room or space in your own personal house to your limited company.

If you choose the second option you will be able to claim for more than the flat rate of £6 per week, however you should ensure that a formal rental agreement has been drawn up and that the cost is reasonable. Also, bear in mind that the income you receive as rent from your limited company needs to be declared on your personal tax return. If you need help deciding which would be the better option for you, then make sure to speak to an accountant.

There are many more allowable expenses which can help reduce your corporation tax, and unfortunately no definitive list supplied by HMRC. One way to ensure you are making use of every allowable expense and tax relief available is to use our company tax return service.

Stay up to date

Looking for some help?

Find more tax planning strategies to minimise your tax bill.