What to do for an HMRC tax investigation

What to do for an HMRC tax investigation

If you’ve received a letter from HMRC informing you of their intention to investigate your tax position, your first reaction may likely be to panic – especially when you’re not sure what it means or what to do for an HMRC tax investigation.

What is a tax investigation?

A tax investigation involves HMRC retrospectively reviewing your tax reporting and payment history. They do this in order to check that the correct amount of taxes have been paid. It is inevitable that they happen as one of HMRC’s top priorities is to close the tax gap – the difference between the amount of tax HMRC should receive (or reasonably expect to receive) and the amount of tax they actually collect.

Over the years, HMRC have received increased powers in order to effectively crack down on tax fraud, avoidance and underpayments. In one of their most recent reports, HMRC claims that there has been a long-term downward decline in the tax gap and that for the tax year 2018/19, the tax gap was at its lowest rate of only 4.7%. Whilst the result of this success is also down to HMRC introducing new digital methods for people to declare and report tax which minimises the opportunities for discrepancies; it is also down to their efforts and evolving strategies when it comes to selecting who to investigate.

How do HMRC decide who to investigate?

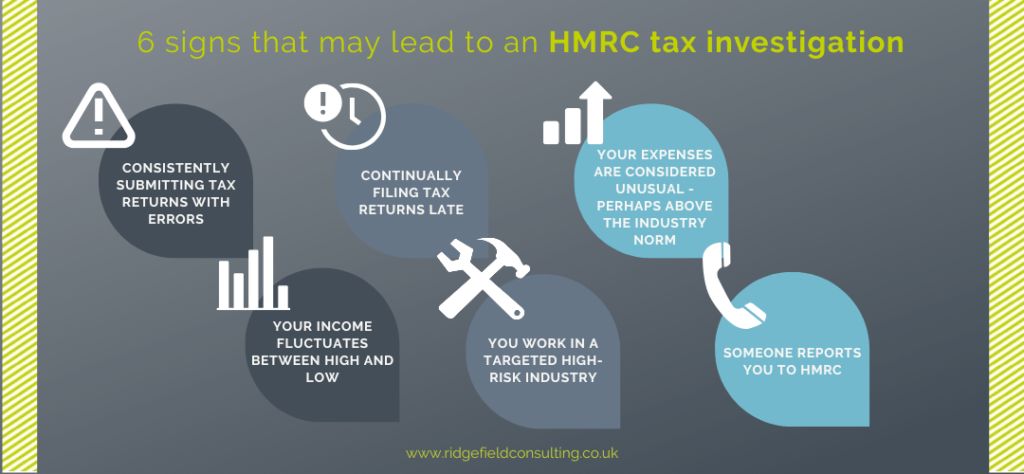

HMRC generally decide to start an investigation due to several possible triggers that are likely to catch their attention:

- Consistently submitting tax returns with errors – these mistakes can include forgetting to tick the right box, missing out sections, or including incorrect calculations, and they are easily spotted by HMRC. Genuine mistakes are not likely to result in criminal prosecution but may still result in penalties.

- Continually filing tax returns late – similar to regularly making mistakes, if you are usually late with filing tax returns (whether that be for your self-assessment, company tax return or VAT return), HMRC are going to want to understand why it is that deadlines can’t be met. It may make them suspicious that you are not keeping correct records and therefore lead to an investigation.

- Your costs or expenses are unusual and may be above the industry norm – whilst HMRC understands that all businesses are different, they will nevertheless still look out for things that don’t make sense. For example, a family-run takeaway in a small town will have very different costs to a Michelin star restaurant in a big city. It may therefore be strange if the takeaway is claiming international travel for business and HMRC will want to find out the reasons behind any odd expenditure to determine if they were legitimate or not.

- You report a large increase or decrease in income – a single dip or rise may not trigger a tax investigation alone. However, HMRC may compare recent tax returns with historical tax returns to see if there have been any extreme changes or regular fluctuations that will raise a red flag. HMRC may also try to decide whether your income is in line with your standard of living as a reason to investigate you.

- You work in a targeted high–risk industry – HMRC will routinely focus on certain industries deemed as high-risk. Over the years this has included the construction industry and private health care professionals, amongst others. More recently, HMRC have shifted their attention to those involved with cryptocurrencies. In general, however, those working in sectors where ‘cash-in-hand’ is common are more likely to be investigated.

- Someone reports you to HMRC – unfortunately, this is not uncommon and HMRC do take notice of accusations. They will weigh up the balance between how much evidence has been provided to support the accusation as well as how much potential tax could be retrieved from the investigation before pursuing.

In addition to the above, HMRC have invested heavily in technology to more accurately identify cases to investigate. Their sophisticated software, known as ‘Connect’, has powerful capabilities to collect data from a vast range of sources including the Land Registry, DVLA, credit card information from issuers, and data from companies such as eBay, PayPal and Airbnb. Not only does it collect data, but it analyses the information and highlights potential cases to investigate, which is yet another reason why HMRC are getting better and better at closing the tax gap.

What do HMRC investigate?

If you receive notification that HMRC are launching an investigation into your tax affairs, they may request to look into your:

- History of tax amount paid

- Bookkeeping, accounts, and tax calculations

- Self-assessment tax return

- Company tax return

- PAYE records and returns if you are an employer

- VAT returns if you are VAT-registered

The letter will also give you more information as to what type of investigation HMRC are conducting:

- A random check – these still occur and can cover any aspect of your tax history and current status. If HMRC carry out a random check, this does not automatically mean they believe you have done something wrong, but that they are simply carrying out standard procedures as part of their overall crackdown on tax avoidance.

- An aspect enquiry – this is where HMRC are only concerned with a certain part of your tax position. For example, they may only want to look into your PAYE records and are not interested in your company tax returns. Often, the most common outcomes to these enquiries are a discovery of genuine mistakes as opposed to intentional tax fraud.

- A full enquiry – during a full enquiry, HMRC will look into all aspects of your tax affairs. This can include both personal taxes as well as any business taxes if applicable. A full enquiry should be taken seriously as HMRC are likely to believe there are significant errors in your tax returns.

What happens during an HMRC tax investigation?

First, you will receive notification (either by post or phone) that HMRC are conducting an investigation into your tax position. They will either request to meet with you at your business premise, your home, at your accountant’s office (if you use an accountant) or ask that you visit them. You are entitled to have a professional advisor such as a chartered accountant present with you at these meetings to help you explain the case. Alternatively, they may not request to meet you at all, but simply ask you to answer some questions or provide records.

If HMRC do request to meet with you, they must provide you with details on what it is they want to discuss. It is advised that you request a full agenda for the meeting, as HMRC must stick to the agenda and not deviate from it. You will need to fully prepare for the meeting and provide any records you have available that they request. If you are aware of any anomalies in your tax history, you should be open and honest, and raise this with HMRC. Whilst HMRC cannot force you to attend any meetings, co-operation on your part will be beneficial to your case.

Where HMRC only ask that you provide records and answer their questions, you must do this within the deadlines given by HMRC. Failure to do so may result in a formal charge against you. If you are unable to meet the deadlines, you should tell HMRC as soon as possible and they may give you more time if they believe your explanation is reasonable. Where you refuse to provide information or records requested, HMRC have the power to go to third parties such as your bank to gather information themselves.

How far back do HMRC investigate?

HMRC are not limited to only checking your most recent tax return but are able to go back to previously submitted tax returns. How long they can go back and raise an investigation depends on the severity of why they are investigating.

For random spot checks, or where there are no significant indications that your tax return was completed incorrectly, HMRC can go back up to 4 years. This will include tax investigations into any capital gains tax (CGT), corporation tax, income tax, PAYE and VAT.

Where HMRC suspect there has been careless mistakes and you have failed to inform them or correct mistakes, HMRC can go back up to 6 years for CGT, corporation tax, income tax and PAYE. For VAT, they are still only permitted to go back up to 4 years.

If, however, HMRC believe that there has been deliberate intention to commit tax fraud or tax evasion then they have the power to go back up to a maximum of 20 years for CGT, corporation tax, income tax, PAYE and VAT. Most people will not keep their tax records for this amount of time, however if you use an accountant to help you complete tax returns, then they may well have your returns archived.

What happens after an HMRC tax investigation?

Once you have provided all the information HMRC have requested, the review will be in their hands. Smaller investigations can take between 3 – 6 months, however full investigations can span up to as long as 16 months. The investigation will end once HMRC has come to a conclusion and this will be marked by a decision notice or contract settlement.

A decision notice is a letter which summarises the final position. HMRC may find that you have overpaid tax, in which case you will be refunded. Where you have underpaid tax or claimed excess tax relief, you will be required to pay the amount outstanding. Depending on the reason as to why they found you to be owing tax payments, they may also issue additional penalties, fines, or interest.

A contract settlement is more common where larger sums of tax are owed. It is a legally binding document whereby you agree to repay outstanding tax instead of forcing HMRC to take matters into their own hands by using their powers to recover the tax forcibly or to charge you with criminal prosecution.

Once an investigation into a certain tax case has been closed, it cannot be re-opened. Where you owe any tax payments or have received penalties, these will need to be paid as quickly as possible. If you disagree with the outcome, you have 30 days to appeal it.

What to do if you think HMRC are wrong to investigate you

When you first receive notification that HMRC are intending to launch an investigation, and you believe that they are wrong to do so, you can write to them in response to ask them to stop. Or, if you are in the middle of an investigation and have provided all evidence they have requested but feel HMRC have not responded to you in reasonable time, you can ask them to close the case. They may not always be able to do so and will tell you why they cannot close the case, such as where they are waiting for information from third parties.

If you disagree with HMRC’s outcome decision, you have the right to appeal. You only have 30 days to do this in writing. You can ask for your case to be reviewed by a different tax officer or heard by an independent tribunal. Appeals can be time consuming, complex, and could require additional records and evidence that you’ll have to dig up. You may also want to seek professional representation to support your case.

Our insight into tax investigations

As a result of all the emergency Coronavirus measures the government launched last year to support businesses and individuals, there is no doubt that HMRC are aware of potential fraudulent claims. We predict that there will be more investigations into SMEs, especially those claiming furlough staff pay. Whilst we would like to re-iterate that not all investigations mean intentional wrongdoing, going through the process of an HMRC investigation can cost more in accountancy fees to support you which are outside your regular fees. You may want to consider taking out Tax Investigation Fee Protection to help you cover these costs.

Stay up to date

Looking for some help?

You can find out more about Tax Planning and Advice to learn about how to manage your tax affairs and reduce your tax bill.