Understanding your profit margin

Understanding your profit margin

When you run your own business, there’s a lot to keep your eyes on. You may need to monitor your stock levels, your numbers of incoming leads, your unpaid invoices, your emails, your appointments, and much, much more. So, with all that to constantly keep on top of, are you also making time to review your profit margin? If not, then how do you know how well your business is doing? Understanding your profit margin can seem like one of those business textbook tasks, but it’s essential to all business owners to ensure your business can stay afloat and make you money.

What is profit margin?

A business’ profit margin is the calculation of the difference between the total expenditure spent to run your business and the sum of all sales it has made. It is commonly used as a measure of success or financial health. The bigger the difference between expenditure and sales means the more money there is left over and therefore the more ‘profitable’ the business. The smaller the difference signifies the opposite and where there is less money that is left over in the business, it may show warning signs that the business is closer to only breaking even or even operating at a loss.

Why is understanding your profit margin important?

Understanding your profit margin is important on many levels. It is not simply a report that needs to be provided as part of your annual accounts. Primarily, it is a reliable indicator that will enable you to stay in control of your business and react accordingly to both opportunities and threats. For example, your profit margin will show you whether you can afford to invest in your business should you want to expand and become even more profitable, or whether it is necessary to make spending cuts to achieve a healthier margin so that the business can continue to survive or weather any temporary struggles.

Understanding your profit margin as well as knowing how to improve it is also important should you need to apply for credit or loans. Creditors will want to see your financial reports, including your profit margin calculations, to determine how reliably and feasibly your business will be able to pay back outstanding debt. Furthermore, if you are looking for investors, then they are likely to want to see high profit margins as this will give them confidence that the business will be able to allocate dividend payments to shareholders.

What are the different types of profit margins?

There are three main different types of profit margins. All of which are useful to understand because they each show your business’ profitability or financial health from slightly different perspectives. Gross profit margin shows a focused picture on the difference between the cost of a product or service and how much the business sells it for. Operating profit margin takes into consideration the cost of the administrative or running costs that are involved in order to be able to sell the product or service. Net profit margin is perhaps most commonly used or seen as most important as it accounts for the entire cost of running your business compared to how much money the business brings in.

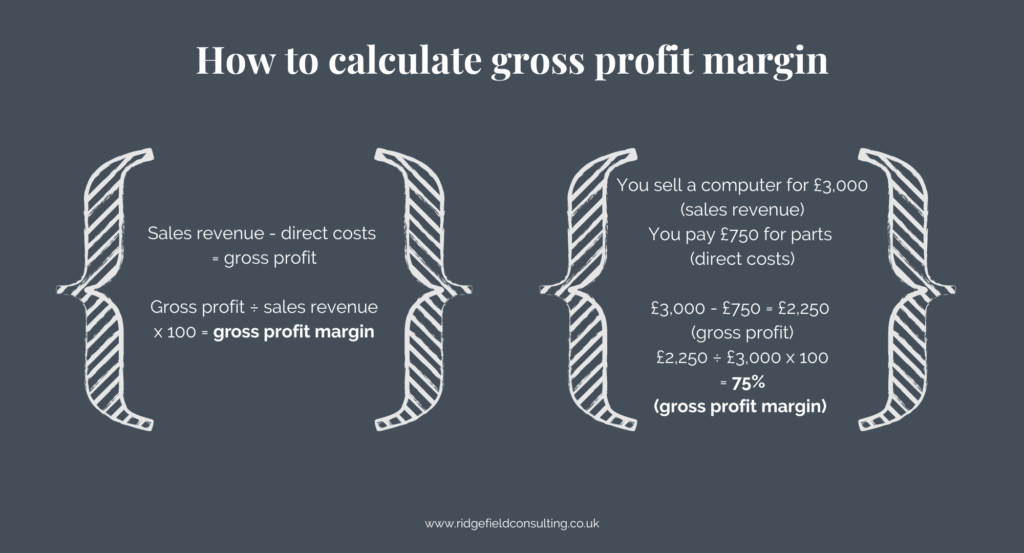

How to calculate gross profit margin

To calculate your gross profit margin, you subtract the total sales of goods or service from the direct costs of producing or supplying the goods or services. The figure is then divided by the total sales figure and multiplied by 100 to provide a gross profit margin percentage figure.

The gross profit margin formula can be followed:

Sales revenue – direct costs = gross profit

Gross profit / sales revenue x 100 = gross profit margin

For example, your business sells custom-made computers and you sell a computer for £3,000. You pay £750 for parts to build the computer. £3,000 – £750 = £2,250 which is your gross profit. £2,250 divided by £3,000 multiplied by 100 is 75% which is your gross profit margin.

If, instead, your business provides a service, you can still use the same formula. For example, you are a graphic designer, and a client has asked you to create an online magazine for them which you charge £1,500 for the project. You would normally charge an hourly rate of £45, and the project takes you 18 hours to complete. In this instance you would calculate your gross profit margin by taking the selling price of your project (£1,500) and subtracting your billable hours of £810 (£45 multiplied by 18) which leaves a gross profit of £690. You then divide this by £,1500 and multiply by 100 which is a profit margin of 46%.

Understanding your gross profit margin is therefore incredibly useful when determining how much to charge for your goods and services. The higher the profit margin, the better, as it will allow you to offer discounts or reductions on your products or services if needed and still be able to make some profit.

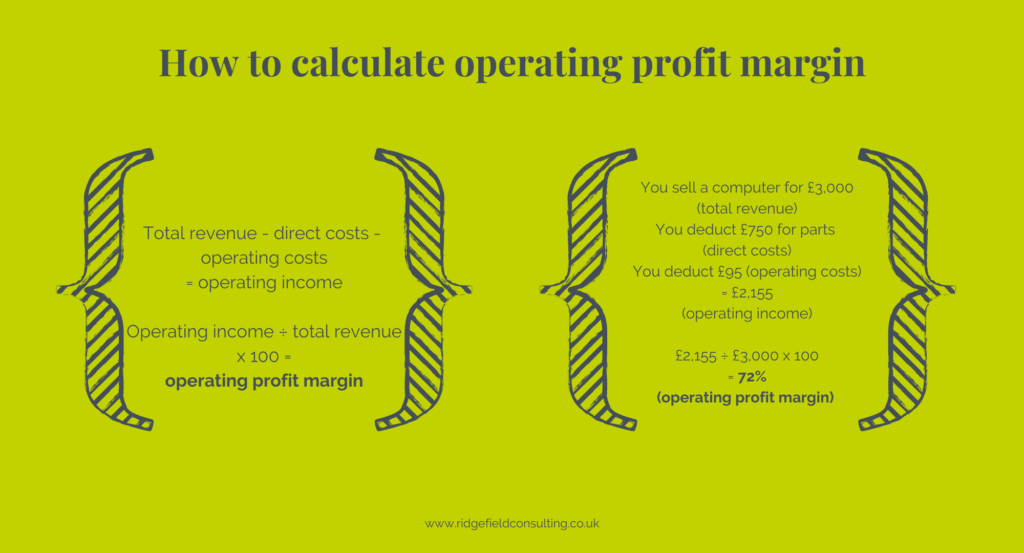

How to calculate your operating profit margin

To calculate your operating profit margin, you must first find out your operating income. This is calculated by taking your total revenue, then deducting your direct costs (as above) but also deducting your operating costs. Once you have this figure you can divide it by your net sales revenue (your sales revenue minus any discounts or returns).

The operating profit margin formula can be followed:

Total revenue – direct costs – operating costs = operating income

Operating income / sales x 100 = operating profit margin

Using the same example of a business selling custom-made computers, the direct costs are still £750 for parts. However, you now need to also deduct operating costs. We will use international courier shipping to deliver the computer to the customer as the cost which is £95. The total revenue is still £3,000 so you now minus £750 and £95 which is £2155. This figure is then divided by £3,000 (still the net sales revenue) and multiply by 100 which leaves an operating profit margin of 72%.

Understanding your operating profit margin is beneficial when you want to see how efficiently your business is running. The higher the operating profit margin the better because it means that the cost of running your business is low compared to the amount of revenue you can make. On the other hand, a low operating profit margin may mean too many costly areas to running your business, but further investigation may allow you to see where you can cut costs.

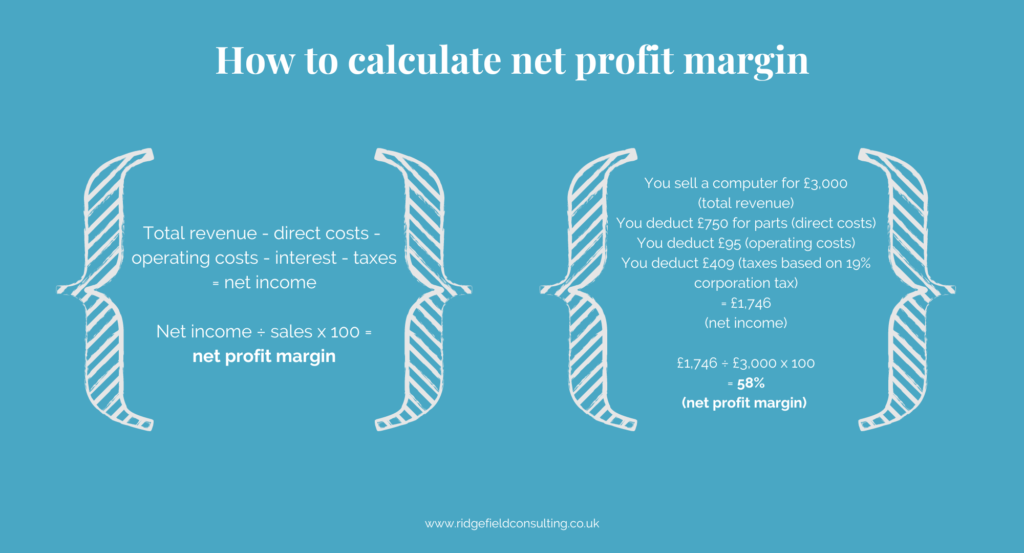

How to calculate your net profit margin

To calculate your net profit margin, you will need to deduct the direct costs, the operating costs, any interest on debts the company has, and taxes owed by the company from the total revenue the company has earned over a set period. This is then divided by the total revenue and multiplied by 100 for the net profit margin.

The net profit margin formula can be followed:

Total revenue – direct costs – operating costs – interest – taxes = net income

Net income / sales x 100 = net profit margin

To illustrate, to find the net profit margin for the computer business above you would take the total revenue of £3,000 for the computer sold and deduct £750 of direct costs, £95 in operating costs, and £409 in taxes (based on 19% corporation tax). This leaves £1,746 (we have left out interest for simplicity). Divide this by the net income of £3,000 and multiply by 100 giving 58% net profit margin.

Understanding your net profit margin arguably gives you the fullest picture of your business’ finances as it takes into consideration every incoming revenue generated and every outgoing expense occurred. The higher the net profit margin, the more the business will be able to allocate in dividends to shareholders or invest back into the business.

How to improve your profit margin

There are 5 main ways any business can improve their profit margin, but you will need to choose which combination of options will be most suitable for your own individual circumstance:

- Choose products or services that allow you to optimise your pricing

If you are selling products which are costly at wholesale prices, it may mean that you’ll be limited to how much you can mark them up by to earn a profit, as the more expensive the item, the less people may be willing to purchase. You should therefore consider choosing products which will enable you to set up a generous mark up as this will still allow you to make a profit even where you need to discount products to clear stock or for promotional periods such as seasonal sales.

If you are providing services for your business, you need to determine which are time consuming or labour intensive and compare this to how much you can charge. You then need to decide whether you would be better off charging less for services you can do quickly if there are many clients looking for this, or whether you should charge for services that take longer but fewer clients are still willing to pay higher prices for.

As you can see, a big part of optimising your pricing will also be down to the demand for your product or service. You can get insight on this by comparing to previous years or looking at your competitors’ offerings.

- Cross-sell or up-sell to increase average sales value

Another way to improve your profit margin is to be able easily to sell more of what you offer. There are various tactics you can use to do this but cross-selling entails that you sell related products and up-selling means you encourage the consumer to purchase a higher-priced option than the original they were considering. Some strategies you can utilise to achieve this are to create bundles where a discount may be offered when more than one item is purchased, giving the purchaser the option of add-ons to enhance their original purchase, or even enabling a customer to personalise their item for an added fee. For service providers, a popular business model used by many industries to try and up-sell is to create tiered service levels such as bronze, silver, and gold so that clients are more inclined to utilise higher service levels.

- Incentivise brand loyalty to increase repeat purchases

Retaining a customer costs far less to a business than it does to gain a new customer, which is why it’s so important for most businesses to maintain good relationships. By being able to rely on a stable and steady stream of income from repeat customers, you can improve your business’ profit margins because for you it means you’ll need to spend less on advertising to maintain sufficient sales or make a profit. Popular ways to encourage repeat custom can include incentives such as loyalty schemes, referral schemes, personalised offers, or subscriptions.

- Reduce unnecessary operating costs

Do a thorough assessment of your business to identify any bottlenecks which may be interrupting smooth and efficient operations. Areas which often greatly make a difference include production, shipping, scheduled down time for maintenance, or training. If there are lots of areas of your business which you outsource, are they all running well together, or is each process reliant upon another being completed on time? You may want to consider bringing areas of operating in-house if you can, to have better control over costs and procedures. If you cannot do this, then assess your suppliers and shop around for the best option.

- Increase productivity

Invest in the best possible work systems for you, your business, and your team to increase productivity. This could be as simple as creating a positive workplace culture where everyone is motivated to do their best work, collaborate, and work towards shared goals. Or it could involve choosing the right software that will allow you to automate and save time from manually doing repetitive jobs. Finding a way to increase productivity can take up the most time as it often requires testing different solutions to find which is best for your business, putting procedures in place, as well as ensuring everyone is aware of which procedures to use. However, learning to work efficiently can be one of the most cost-effective ways to improve your profit margins.

Get help with understanding and improving your profit margin

If you’re struggling to understand your profit margins, then you may benefit from our management accounts service. We cover much more than just your profit margins, but other key performance indicators relevant to your business, as well as provide analysis alongside financial reports so that you can make the best decisions to grow your business. If you’d like to find out more then please use the contact form to get in touch with us to book in a consultation to discuss your business.

Stay up to date

Looking for some help?

You can find out more about our Bookkeeping Service.