What is Cloud Accounting?

What is Cloud Accounting?

If you’re not hearing about Cloud Accounting from your accountant, then you’re likely to be coming across it on the TV or the radio, but do you still feel in the dark about what it is or does? We shed some light on the topic by explaining why cloud accounting is becoming increasingly popular, how it helps people who are self-employed or own a small business, and why it will soon be essential to use.

Cloud accounting is also often referred to as online accounting. It is software which allows you to manage your business finances without having to be tied down to a physical location or specific device such as a desktop PC. Similar to apps you may already be using such as online banking or email, you can access cloud accounting anywhere with an internet connection. Your data is stored safely in digital format online which can be accessed by logging into your account.

Cloud accounting is becoming increasingly popular due to its easy-to-use functionality and convenience. With cloud accounting software you can manage your business affairs, such as pay a bill, issue a quote or chase an invoice with a few clicks of a button using your mobile, iPad or laptop. You can instantly check your balance as well as see money due to come in or bills to be paid. You can generate reports on how your business is performing, manage your payroll and complete your VAT return. What’s more, it allows you to do all this without having to wait until you return to the office.

In addition to its growing popularity, cloud accounting is important because it plays a vital role in Making Tax Digital. As the tax return process transitions to becoming a completely digital process, it can only be achieved by utilising online accounting software. One of the requirements is that businesses will have to file four quarterly tax return forms instead of the present single annual tax return. The tax return forms must be submitted to HMRC using cloud accounting. Furthermore, HMRC will only accept records that have been kept using software which is compatible with their own online platform (cloud accounting software as opposed to traditional desktop software such as Excel spreadsheets).

If you are hesitant to switch to cloud accounting, here are 5 reasons why business owners have said that cloud accounting has helped them:

1. Your accounts are always safe and secure. Never worry about losing your records if there’s a technical error or your computer crashes. Cloud accounting regularly backs up all your data.

2. Cloud accounting is always accurate with your current cash flow. Instantly see exactly what money is owed, due, needs to be paid, or is available which will allow you to make sensible spending decisions.

3. Improve your business by becoming more efficient. Easily and quickly send a quote or chase up on an invoice through a few clicks of a button. Not only that but you can monitor your business by generating profit and loss reports without having to calculate anything yourself.

4. Managing your business becomes more convenient than ever. With access to all features whenever and wherever you have an internet connection, there’s no need to wait to go back home or to the office (you could even check things are running like clockwork whilst on holiday if you wanted!)

5. Cloud Accounting will actually save you money! By providing your accountant with the records they need in a ready-to-use format you will save on the fee your accountants will charge in order to comply with Making Tax Digital.

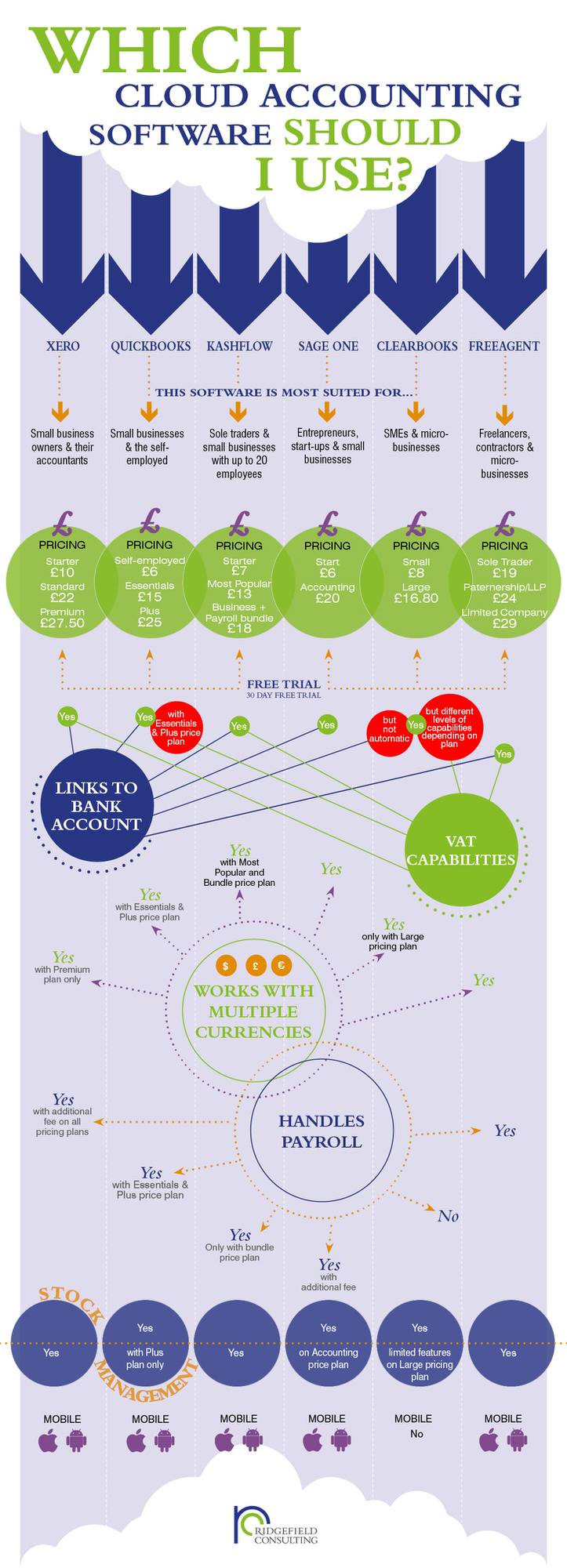

To help you decide which cloud accounting software is right for you and your business, see our impartial infographic below:

Stay up to date

Looking for some help?

You can find out more about our payroll service.