Different ways to claim tax relief when working from home

Different ways to claim tax relief when working from home

Working from home has become increasingly common as more and more people seek flexible work arrangements in order to fit in with lifestyle commitments. Adding to this trend, the Coronavirus pandemic has forced a huge section of the population into working remotely from home instead of regularly commuting into the office. As a result, people spend significantly more time at home, which in turn means they are likely to see an increase in household bills.

HMRC allow workers to claim tax relief for some of the additional costs incurred by working from home. However, what can be claimed, how much, and how to claim it, will be dependent on whether you are a sole trader, limited company owner/director, or an employee.

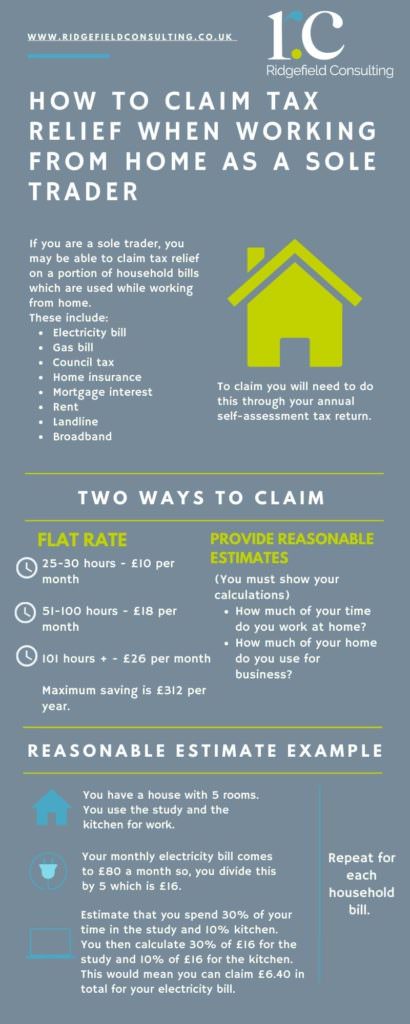

Claim tax relief as a sole trader working from home

Sole traders are able to claim tax relief on a portion of household bills that have been used due to working from home. These can include:

- Electricity bill

- Gas bill

- Council tax

- Metered water bill (only where this is for business use such as if you run a catering service)

- Home insurance, unless your business has separate insurance

- Mortgage interest, but you cannot claim any part of the repayments towards capital

- Rent

- Household repairs and maintenance where it affects your business use (you cannot claim for things such as a new bathroom suite, but you may be able to claim repainting your office room which you use to meet with clients)

- Business calls on a landline

- Broadband

To claim, you will need to do this through your annual self-assessment tax return. However, when it comes to calculating how much you can claim, there are two options. The first way you can claim is the simplest and this is by claiming a flat rate depending on the number of hours you work from home per month. The flat rate allowances are set out by HMRC as follows:

- 25 – 50 hours: £10 per month

- 51 – 100 hours: £18 per month

- 101+ hours: £26 per month

The flat rate allowance may not appear too generous; however, it is still a maximum saving of £312 per year. Alternatively, you can choose to claim a more precise proportion of household bills if this would enable you to receive a larger tax saving. To do this, you must provide reasonable estimates and show your calculations. HMRC do not have fixed rules as to how you should make these calculations as they recognise that each individual’s circumstance will be different. For example, those who live and work in a house with multiple bedrooms will calculate their expenses very differently to someone who lives and works in a studio apartment.

As a general rule for calculations, you should consider two variables:

- How much of your time do you work at home?

- How much of your home do you use for business?

Being self-employed can often come with the freedom of choosing where you work. For many sole traders, this means spending working hours at home. However, it is important to note that HMRC will consider the type of work you do to ensure it makes sense when it comes to how much you claim for in working from home expenses. For example, if you are a maths tutor, you may spend time working in your own home as well as at students’ homes. However, if you work as a builder, then it becomes much more unlikely that you’ll spend significant amounts of time working at your own home. Be aware of this and be realistic when it comes to allotting how much time is spent working from home.

HMRC will also want you to consider how much of your home is being used for work. For example, it will be unlikely that you will be able to claim working from your bathroom or children’s bedroom. However, it may be realistic that you work 80% of the time in a study and 20% of the time in your kitchen. If you live in an open plan space or studio, then you may want to consider a percentage of the overall floorspace. In general, it is recommended that you do not use one room or part of the house exclusively for business only as this can attract capital gains tax when it comes to selling your property later.

Once you have considered these two factors, you can base your calculations on the facts. One way you could do this is to take the costs of your eligible household bills and divide by the number of rooms in the house. Then determine which rooms you actually use for work and allocate a percentage of time that the rooms are occupied for work.

To illustrate, we can use an example where there are 5 rooms in total in your house and you use the study and the kitchen. Where your electricity bill for the whole house comes to £80 for a month, you would divide this by 5 (the number of rooms in your house). You may then estimate that you spend 30% of your time using the study for work and 10% in the kitchen. You could then calculate 30% of £16 (the average cost to run electricity in each room of your house) for the study and 10% of £16 for the kitchen as a fair portion of the electricity bill used for business purposes. You would claim £6.40 in total. This method can be repeated for each of the household bills.

HMRC have provided more examples of different ways you can calculate a reasonable portion of costs due to working from home. The examples are not exhaustive and have only been intended to demonstrate different principles applied. If you need advice or help on how to claim tax relief in this way, please feel free to contact us.

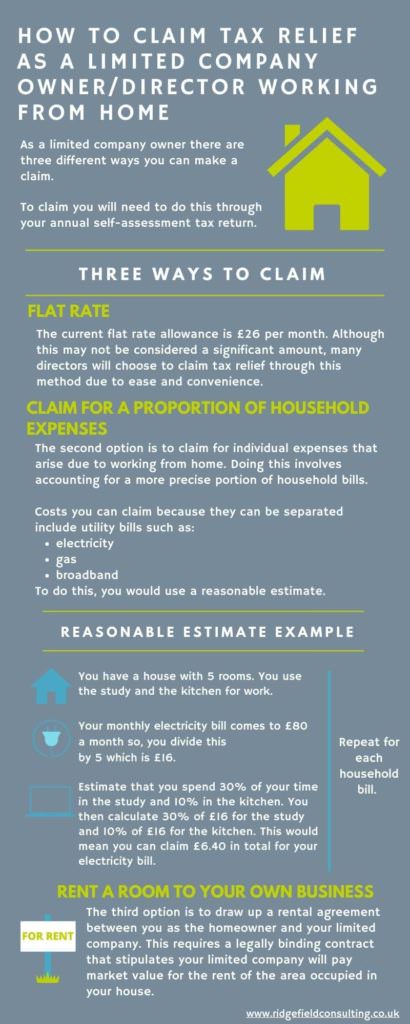

Claim tax relief as a limited company owner/director working from home

Many limited company owners do not need to own a separate premise for their business and can feasibly work from home. There are three different ways you can make a claim, and which you choose will most likely be down to either which will save you the most in tax, or which would be the most convenient for you.

- Claim the HMRC flat rate allowance

As with claiming tax relief for working from home as a sole trader, claiming the HMRC flat rate is by far the simplest method. HMRC allow all limited companies to pay a tax-free fixed amount to each employee that is required to work from home as a way of contributing towards additional household bills. Owners of limited companies are both the director and an employee of the company, and so it is possible to pay yourself the flat rate from your business. This benefits both you and the business as you are not required to pay income tax on this amount, and your business is able to claim the amount as an allowable expense which will reduce the corporation tax bill.

The current flat rate allowance is £26 per month. Although this may not be considered a significant amount, many directors will choose to claim tax relief through this method due to ease and convenience.

- Claim for a proportion of household expenses

The second option is to claim for individual expenses that arise due to working from home. Doing this involves accounting for a more precise portion of household bills and you may want to choose this option where you spend significant amounts of time working at home and would be able to claim more than the flat rate offered by HMRC.

However, this option does involve more work when it comes to completing your company tax return, and, unlike the expenses that can be included for sole traders, limited company owners are not able to claim for fixed home costs such as mortgage interest or council tax. Similarly, you cannot claim costs that have a ‘duality of purpose’ which means anything that has both personal and business use which cannot be separated. An example of this may include replacing a broken coffee table which you use when meeting with clients, but also use in the evenings with your family.

Costs you can claim because they can be separated include utility bills such as electricity, gas, and broadband. To do this, you would count the number of rooms in your house and consider the percentage of time each room is used for work, then use the same calculations outlined above in the sole trader section.

- Rent a room to your own business

The third option is to draw up a rental agreement between you as the homeowner and your limited company. This is the most formal arrangement by far and requires a legally binding contract that stipulates your limited company will pay market value for the rent of the area occupied in your house. We would advise you to obtain a formal valuation completed by an estate agent to ensure you comply with rules and regulations.

Before proceeding with this option there are several considerations you should make:

- If you have a mortgage on your home, does this allow you to use the property for business purposes?

- If you rent your property, are you allowed to sub-let to a business?

- Does your home insurance policy cover business usage?

- If the room(s) will be solely used for business, you may lose your capital gains tax exemption that applies to your main residence if you choose to sell the house.

- The rent that you will receive from your limited company will be subject to income tax.

Despite the involved process necessary to use this third option, it may still have tax benefits and advantages for your business. It is therefore recommended that you consult with a chartered accountant to understand the potential tax liabilities in order to determine if this would achieve your desired outcome.

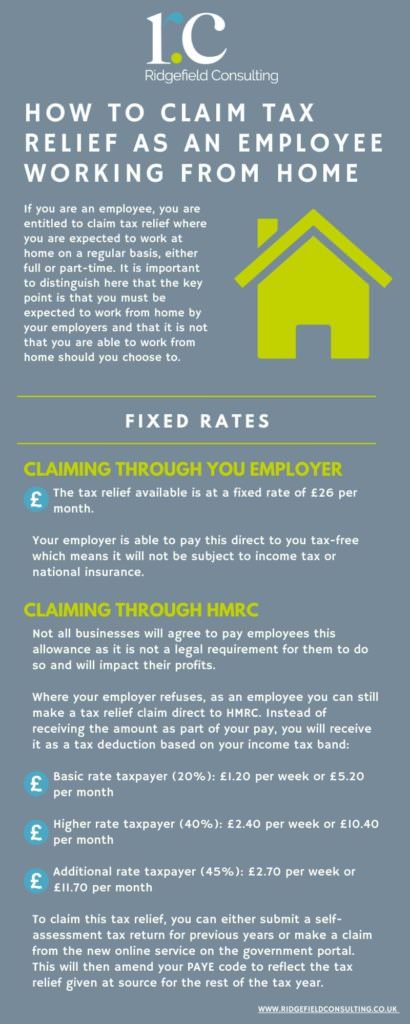

Claim tax relief as an employee working from home

If you are an employee, you are entitled to claim tax relief where you are expected to work at home on a regular basis, either full or part time. It is important to distinguish here that the key point is that you must be expected to work from home by your employers, and that it is not that you are able to work from home should you choose to.

The tax relief available is at a fixed rate of £26 per month. Your employer is able to pay this direct to you tax-free which means it will not be subject to income tax or national insurance. If you have expenses over this amount incurred as a result of working from home, you may be able to claim this also but will need to provide evidence such as receipts, bills or contracts.

However, not all businesses will agree to pay employees this allowance as it is not a legal requirement for them to do so and will impact their profits. Where your employer refuses, as an employee you can still make a tax relief claim direct to HMRC. Instead of receiving the amount as part of your pay, you will receive it as a tax deduction based on your income tax band:

- Basic rate taxpayer (20%): £1.20 per week or £5.20 per month

- Higher rate taxpayer (40%): £2.40 per week or £10.40 per month

- Additional rate taxpayer (45%): £2.70 per week or £11.70 per month

To claim this tax relief, you can either submit a self-assessment tax return for previous years or make a claim from the new online service on the government portal. This will then amend your PAYE code to reflect the tax relief given at source for the rest of the tax year.

In order to be able to work from home, you may require additional equipment to be supplied by your employer which can include furniture from a desk and chair to equipment such as a monitor stand or printer. You are able to receive these tax-free so long as they are paid for and supplied to you by your employer, are only used for work purposes (negligible amounts of personal use will be acceptable) and that the items should be returned to your employer when you no longer work for them. Where you pay for the equipment yourself and your employer reimburses you for the costs, you may incur income tax and national insurance (NI) contributions as they become a benefit-in-kind.

In the current state of the Coronavirus pandemic however, HMRC have relaxed rules from 16 March 2020 for the 2020/21 tax year. It means all employees are able to purchase equipment necessary for completing their work at home and be reimbursed by employers without attracting income or NI contributions. Nevertheless, it will still be important that you are able to demonstrate the equipment has been purchased for the purpose of working and that there is little personal use if any.

If you have been experiencing any other regular expenses as a result of working from home during the Coronavirus pandemic then find out if you can claim them on your self-assessment tax return during a Introductory call.

Stay up to date

Looking for some help?

You can find more about our Personal Tax Advice.