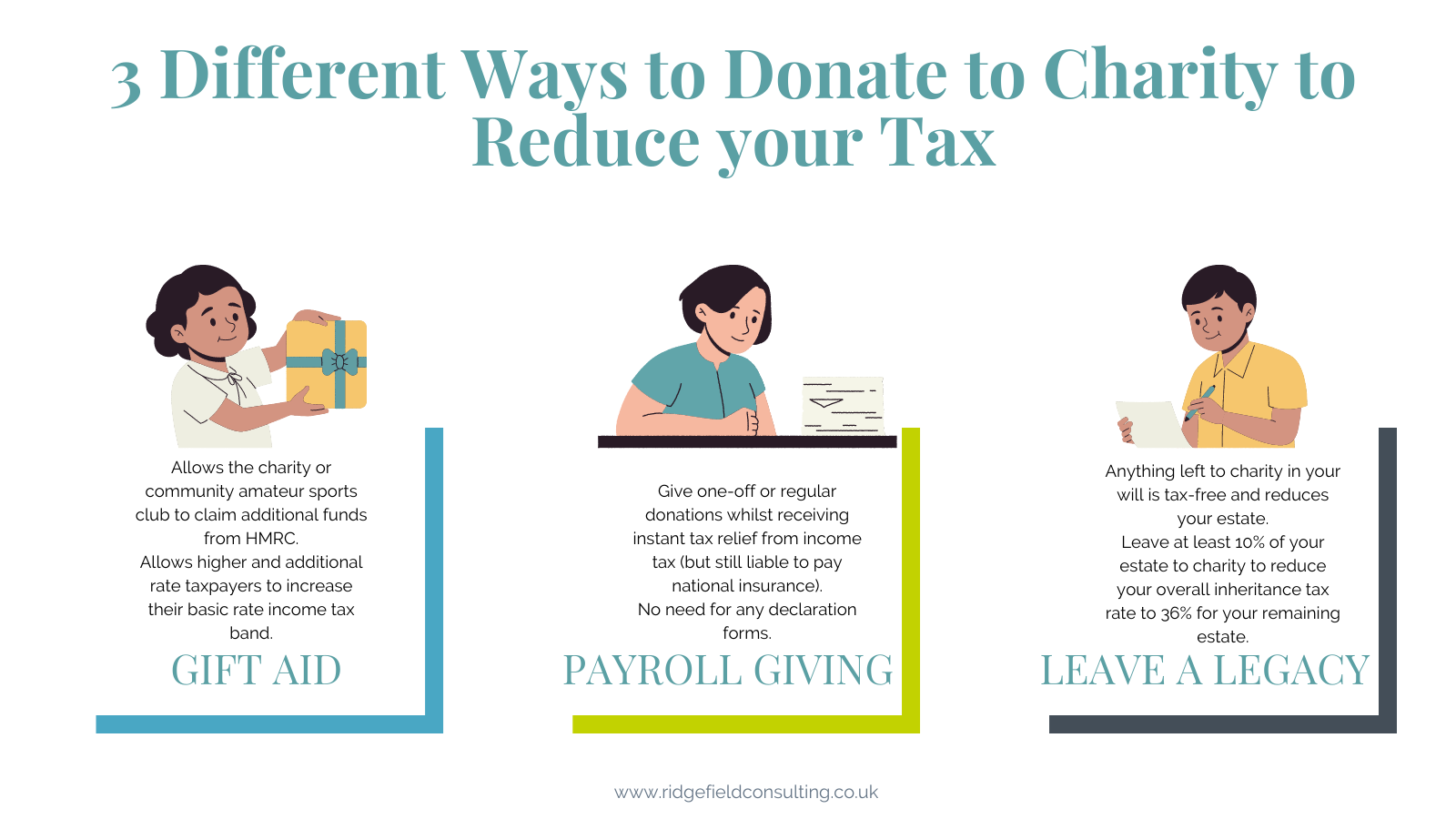

3 Different ways to donate to charity to reduce your tax

3 Different ways to donate to charity to reduce your tax

To encourage the public to support charitable organisations, the UK government incentivises charitable giving by offering tax relief in exchange. Despite this, donating to charity can be a commonly overlooked tax planning strategy and may be due to a lack of understanding on how these tax relief schemes work. In this article, we explain how three different ways to donate to charity can reduce your tax liability. Not only are you able to take advantage of the tax relief, but, depending on how you choose to donate, the charity itself could also be able to benefit by receiving a boost in funds from HMRC.

1. Donate through Gift Aid to reduce your income tax or capital gains tax

Gift aid is a scheme that enables charities as well as community amateur sports clubs (CASCs) to claim additional funds from HMRC with every donation you make to them. It works by allowing them to receive the basic income tax rate on top of the value of your donation. This can confuse people as for every £1 you donate; the charity actually receives £1.25 – which is more than the basic income tax rate. Whilst the basic income tax rate is 20%, this is calculated on your gross donation (the amount of money you donate before any tax has been deducted). So, if you donated £10, this would actually equate to £12.50 because 20% of £12.50 is £2.50. The charity receives the £2.50 from HMRC which is on top of the £10 you donated.

In order to use the gift aid scheme, you must be a UK taxpayer and pay at least the same amount of income tax as the value of your donations. If your circumstances change and you are no longer paying enough income tax (for example if you are going on maternity leave or retiring) then you will need to inform the charity, otherwise you’ll be liable to pay any difference back to HMRC. The donation must be made personally by you as opposed to funding efforts you’ve contributed to such as a bake sale. Goods you donate to a charity shop can still be included in gift aid as the charity will claim on the value your goods sell for. The charity will ask you to complete a declaration form that states you are paying sufficient income tax to cover the gift aid and you will need to provide additional personal details including your full name and address.

If you are a higher or additional rate taxpayer, you can benefit even further from donating via the gift aid scheme. The charity is still able to receive the basic income tax rate in addition to your donation, however you further benefit by being able to extend your basic income tax rate by the difference between your tax rate and the basic income tax rate of the amount you donated. To illustrate: if you are a higher rate taxpayer paying 40% income tax and you donate £1,000 to a charity or CASC via gift aid, the charity receives £1,250. You receive 20% of £1,250 as tax relief because 20% is the difference between your tax rate and the basic income tax rate. The tax relief is given to you by way of extending your basic income tax rate. This means that whilst the current threshold for the basic income tax rate is £50,270, by donating to a charity or CASC by gift aid, you can earn up to £50,520 and only pay the 20% income tax rate in this example. To claim this tax relief, you will need to include the donation amount on your self-assessment tax return.

2. Donate through Payroll Giving to reduce your income tax

The Payroll Giving scheme (sometimes also called Give As You Earn) was first introduced in 1986 and allows you to make donations direct from your PAYE income before tax (but after National Insurance contributions). Donating to a charity or CASC this way will allow you to immediately benefit from tax relief at your personal income tax rate. It can therefore be more beneficial to basic rate income taxpayers to donate through Payroll Giving as opposed to Gift Aid. However, doing so will mean that charities lose out as tax would not have been paid on your donation, preventing them from claiming it as additional funding. Payroll giving is nevertheless still a great way to donate to a charity or CASC as well as costing you less to give more:

- Basic rate taxpayers will see £8 deducted from their salary to donate £10 to a charity

- Higher rate taxpayers will see £6 deducted from their salary to donate £10 to a charity

- Additional rate taxpayers will see £5.50 deducted from their salary to donate £10 to a charity

To use the Payroll Giving scheme you must speak to your employers, as they must set it up with their payroll department. They will need to select an approved Payroll Giving agency who will receive your donation direct from your salary each month and then pass it onto the charity of your choice. You should take note that often these agencies will take around a 4% fee of your donation to do this, although many employers will choose to pay this fee so that it does not have to come from your donation.

Payroll Giving is a highly flexible and convenient way to donate to charity as it allows you to make regular or one-off donations to as many different charities as you would like without the administrative task of completing the declaration forms. Not only that but you can easily choose to stop the donations at any time, and if you leave the company, the donations will stop at your last pay.

3. Leave charitable donations in your will to reduce inheritance tax

Many people choose to leave charitable donations in their wills. Whilst it may not be your intention to do this as part of tax planning, it nevertheless does come with additional tax-saving benefits. Anything you donate to a charity in your will is exempt from inheritance tax (which is currently set at a rate of 40%). This will reduce the final value of your estate and will not take up any part of your nil rate band or residence nil rate band.

For example, an individual has an estate worth £800,000 after both the nil rate band and residence nil rate band has been accounted for. The individual leaves their estate to their children. 40% inheritance tax on £800,000 is £320,000, leaving the children £480,000. However, say instead the individual wanted to leave £50,000 to charity. This reduces their estate to £750,000 where £300,000 must be paid as inheritance tax, leaving the children £450,000. Although the children do receive less (by £30,000), the charity receives £50,000, thereby allowing the individual to give £20,000 more (they leave a total of £500,000 to their children and charity instead of £480,000 to just their children) from their estate than before.

If you decide to leave at least 10% of your final estate to a charitable organisation, then the rate of inheritance tax reduces to 36% on your remaining estate. Again, if you want to be able to leave more in your final estate, then, by donating to a charity, you can save on inheritance tax.

Using the same example as above, where the individual has an estate of £800,000, they instead leave £80,000 to charity. This reduces their estate to £720,000 and instead of the standard 40% inheritance tax rate, the rest of the estate is now subject to a lower 36% inheritance tax rate. The individual can therefore leave £460,800 to their children which is £10,800 more than in the example above. Furthermore, the individual is able to leave a total of £540,800 to both children and charity instead of £500,000 in the example above.

Get help with claiming tax relief from charitable donations

Whichever way you are planning to donate to charity, if you need assistance with your self-assessment tax return to completing your payroll for your employees or even tax planning for your estate, you can receive expert advice on your personal charitable giving goals during a introductory call with one of our accountants.

Stay up to date

Looking for some help?

You can find out more about our Personel Tax Planning service.