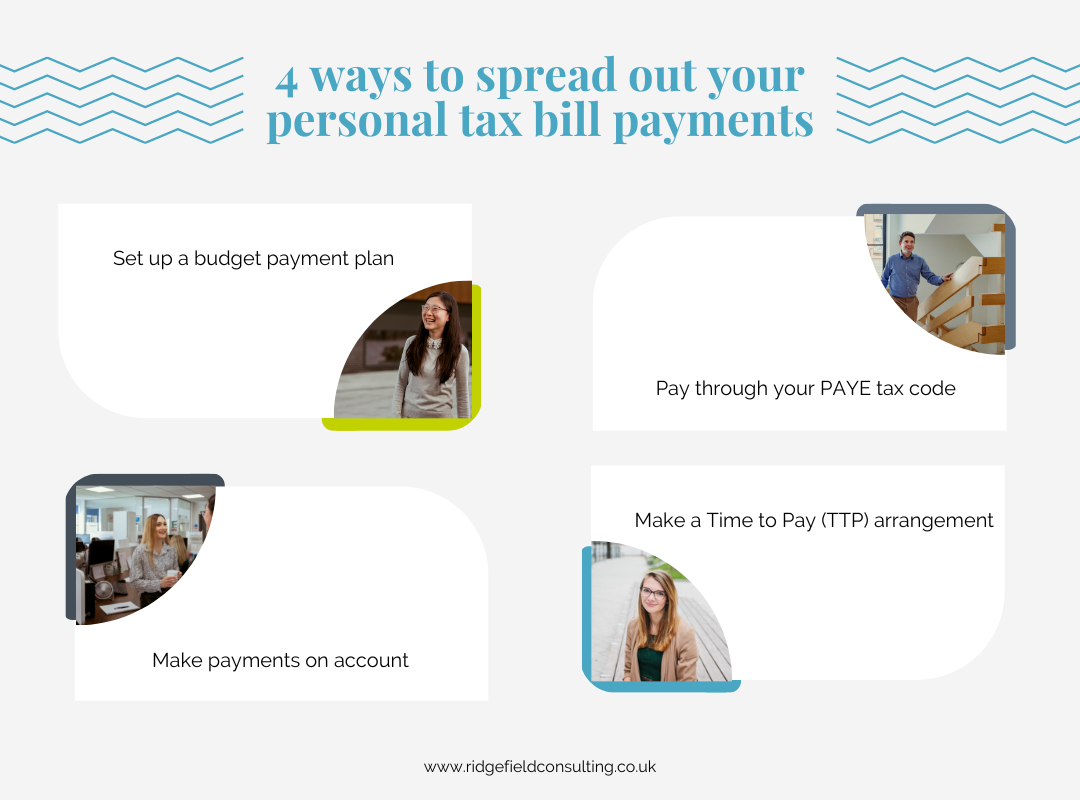

How to spread out your personal tax bill payments

How to spread out your personal tax bill payments

Spread out your tax bill by setting up a budget payment plan

Spread out your tax bill by paying through your PAYE tax code

Listen to our podcast version of this article:

Facing the 31st of January tax deadline is dreaded by many but learning the different ways you can spread out your personal tax bill can offer a lot of relief knowing that the final bill will be manageable. Lots of people are so daunted by the prospect of paying for a large tax bill that they avoid filing their tax return altogether. However, we strongly urge everyone to do the exact opposite as there are benefits when you complete your self-assessment tax return early. If the benefits are not enough to convince you, then avoiding the automatic £100 late filing penalty as well as interest added when payment is late should be a solid enough financial reason for getting your tax return completed on time. For anyone who struggles to pay their tax bill at the end of January, try using one of the below methods to break up your payments into smaller amounts.

Spread out your tax bill by setting up a budget payment plan

Setting up a budget payment plan is one of the most flexible ways to spread out your personal tax bill payment. You can choose whether to make weekly or monthly payments, decide exactly how much you want to pay regularly, and even pause payments for up to 6 months whenever you need.

To do this, you must be up to date with any self-assessment tax return bills. So, if you are still in the process of paying a previous tax year’s personal tax bill you will be unable to set this up. However, if you are eligible then getting a budget payment plan arranged is simple.

You first need to log into your HMRC online account and then choose the option to set up a direct debit. Follow the instructions and make sure to use your 11-character payment reference when setting up the direct debit. This will be your 10 digital Unique Taxpayer Reference (UTR) followed by the letter K.

If, come 31st January, there is still an amount outstanding because the regular payments were insufficient to cover your whole tax bill, then this will still need to be paid by the deadline. However, if you have overpaid from your budget payment plan then you will be due a refund which you can request. Alternatively, you could leave any overpayment on your account to put towards your next year’s tax bill.

Spread out your tax bill by paying through your PAYE tax code

Another easy way to break up your tax bill payment is to get it automatically deducted through your PAYE tax code. This is a highly convenient method to pay your tax bill; however less flexible than setting up a budget payment plan as you cannot control how much to pay or pause the payments if you wish as HMRC will automatically split your tax bill into 12 monthly payments.

Paying your tax bill in instalments through your PAYE tax code means that your total tax bill will be split into smaller amounts and deducted directly from any income that is paid to you via a PAYE (pay as you earn) system such as your salary paid by an employer, or your pension paid by a pension provider. You will notice this has happened through the change in your tax code as well as receiving less in your payslip or pension slip. This method allows you to not have to worry about the tax deadline at all (with the exception of filing your tax return on time) as paying your tax will be automatically taken care of.

To be able to use this method, you must have completed your self-assessment tax return by 31 October if you submit by paper format or 30 December if you file your personal tax return online. Your total tax bill cannot be more than £3,000 and you must be receiving PAYE income. You can select the option to pay through your PAYE tax code on your tax return to use this method.

Spread out your tax bill with payments on account

If your tax bill is over £3,000 for the tax year and you are unable to select paying for your tax bill through your PAYE tax code, HMRC will enrol you onto the payments on account scheme. This splits an estimate of your tax bill (based on your previous year’s tax bill) into two advance payments which are due 31 January and 31 July. Be aware that payment is not taken automatically, and you must ensure that you pay by the deadlines. If your tax bill come the 31 January is over the estimate, then you will need to pay any outstanding amount by the 31 January tax deadline as well.

There is nothing you need to do to split your tax payments by the payments on account method as HMRC will automatically do this for you. There is also no option to opt-out of this arrangement, however you may be exempt if over 80% of your total income is taxed through PAYE. You can also apply online to reduce the amount you have to pay on your payments on account if you expect your income to go down or the tax relief you are entitled to goes up.

Make a Time to Pay (TTP) arrangement if you are unable to pay your tax bill in time

A Time to Pay (TTP) arrangement is the best solution if you are unable to pay your tax bill in full on time. If you have missed the deadline or know you will miss paying in full by the tax payment deadline, then the best advice we can offer is to contact HMRC as soon as possible. A TTP arrangement will allow you to spread out the tax bill that is overdue and is completely flexible, negotiated directly with HMRC, and based on your own personal financial circumstances so there is no one standard payment arrangement. They can not only cover the tax owed, but any late penalties and interest as well. There is complete flexibility with the time you have to repay any tax debt and no formal contract to adhere to.

To arrange a TTP, you can call HMRC directly to speak to someone who will assess your income and expenditure to determine your disposable income and how much you’ll be able to afford to pay. Or you can arrange a TTP yourself online so long as you have filed your latest personal tax return, owe less than £30,000, are within 60 days of the payment deadline and intend on being able to pay off your debt within the next 12 months or less.

Get help with your self-assessment tax return

The first step in tackling your personal tax bill is always to find out how much it is you will owe. To do this, you’ll need to complete your self-assessment tax return which is why we always recommend completing it sooner rather than later. Getting professional tax advice from expert chartered accountants can help you minimise your tax bill as we’ll be able to easily spot eligible deductions available. Book in for a introductory call to discuss completing your tax return.

Stay up to date

Looking for some help?

You can find out more about our Self-Assessment Tax Return service.